The New Capital Journal

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Managing Liquidity Risk in the World’s Deepest Bond Market

Liquidity has been evaporating from the Treasury market. Vanguard's active fixed income funds are managing for stability.

Benefits of Establishing a Minor IRA

A minor IRA can be a valuable tool for teaching a variety of financial lessons, from deciding how much to save, to managing taxes and investing.

Time to Have a Family Money Meeting?

See how one family learned to be more open when talking about money with their children.

How Do the Midterm Elections Impact the Outlook for Markets and the Economy?

Politics will always be a source of uncertainty for markets, but it’s policy, not politics, that is more influential for the economy and markets in the long run.

Avoiding Taxable Transactions: IRA Rollovers

New Capital assists our clients with rollovers on a regular basis. Let us know if we can help you.

Weekly Market Commentary

U.S. stocks surged and Treasury yields fell sharply after the core October CPI rose a lower-than-expected 0.3%. We think this is finally an encouraging development on inflation but doesn’t yet change the overall picture.

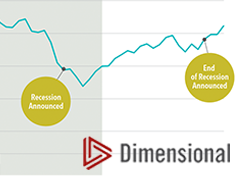

Markets Don’t Wait for Official Announcements

Some investors may worry about the stock market sinking after a recession is officially announced. But history shows that markets incorporate expectations ahead of economic reports.

What Is the Outlook for Long-Term Returns?

Markets offer the best potential long-term returns in more than a decade.

When Higher Inflation Meets Your Withdrawal Rate

While few are predicting a 1970s-style inflation spiral, it’s still worth thinking through how inflation could affect your plan.

Is a Slower Rate Hike Path on the Horizon?

Powell suggested that a smaller pace of rate hikes may come as soon as the next meeting, but emphasized that the more important question is how high rates need to go, and for how long.

IRS COLA Changes for 2023

Inflation is typically hard on retirement savers. As inflation cumulates year over year, an account balance will be losing purchasing power even if it’s still growing.

The Red Flags of Elder Financial Abuse

Combatting fraud takes education and a plan for trusting the right people.

Trust the Financial Advisor Who Trusts the Market

With over 200,000 financial advisors in the United States, how do you pick one?

Market Perspectives: November 2022

Vanguard November Market perspectives offers global economic and security returns forecasts.

An Action Plan for Long-Term Care

Many people put off creating a long-term-care plan. This step-by-step guide can help you get over inertia, dread, or both.

Policy Reality Check: Tighter for Longer

Just like in the early 1980s, central banks are committed to the fight against inflation. However, this time is different. Alternative data reveals insight into the current economic backdrop and what it means for investors.

What Should Investors Expect for 3Q22 Earnings?

Profits in sectors with greater operating leverage should be more resilient given elevated inflation over the next few months, but as economic growth begins to slow and inflation cools, we may see investors rotate back into the growthier parts of the market.

Could You Be A Target for Cybercrime?

Understanding the potential threats can help keep your online accounts safe.

What a Strong U.S. Dollar Means for Investors

Some company earnings could falter. Here's what to expect.

Quarterly Market Review - Q3 2022

The DFA Quarterly Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.