IRS COLA Changes for 2023

Inflation is typically hard on retirement savers. As inflation cumulates year over year, an account balance will be losing purchasing power even if it’s still growing.

Inflation is typically hard on retirement savers. As inflation cumulates year over year, an account balance will be losing purchasing power even if it’s still growing. For example, a shirt purchased for $20 in 1995 would cost almost double ($38.95) today.1 One way to combat this predicament, of course, is to save more for retirement. The higher your account balance, the better equipped you’ll be to pay for goods and services during your retirement.

Assuming you can afford to save more to hedge against inflation, the current high inflation rates may actually be helpful. The maximum permitted contribution to a tax-advantaged retirement savings account each year is adjusted annually relative to the cost-of-living index. As the cost of living goes up, so too do the contribution limits. For 2023, the IRA contribution limits will be increasing, as will the income limits that determine who can take a tax deduction for a Traditional IRA contribution and who can contribute to a Roth IRA.2 This means more taxpayers will be permitted to save more in an IRA in 2023. The contribution limits for those who participate in a SEP or SIMPLE IRA plan or other retirement plan at work will also be increasing. Take a look at these updated values below as we highlight the changes and answer some important savings-related questions.

Traditional and Roth

How Much Can I Contribute to an IRA?

The maximum amount you may contribute to an IRA is 100% of your compensation up to the annual dollar limit. If you are age 50 or older, you have the option of making an additional contribution for the year. You have one annual contribution and a catch-up contribution limit for all your Traditional and Roth IRAs.

Who Can Deduct a Traditional IRA Contribution?

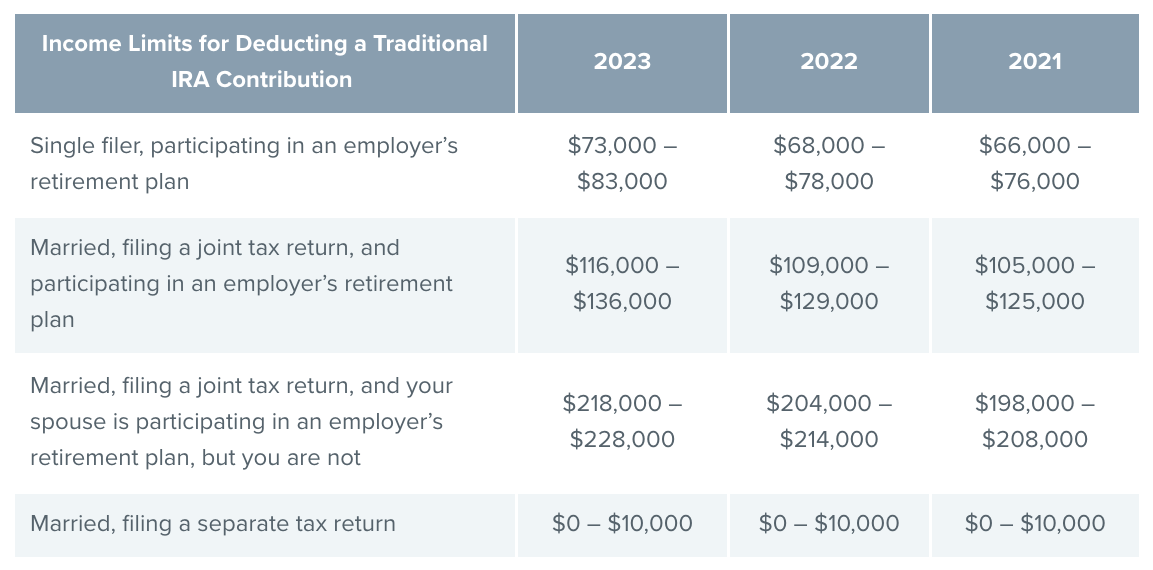

Traditional IRA contributions are generally fully deductible – unless you or your spouse is covered by an employer’s retirement plan, such as a 401(k) plan. If you or your spouse is participating in an employer plan, the deductibility of your Traditional IRA contributions will depend on whether your modified adjusted gross income (MAGI) exceeds the limits applicable to your tax-filing status for the year. See the table below.

For example, if you are married, filing a joint tax return, and are participating in a 401(k) plan at work in 2023, your annual IRA contribution will be fully deductible if your MAGI is below $116,000, and partially deductible if your MAGI is between $116,000 and $136,000. If your MAGI is $136,000 or higher, your Traditional IRA contributions will not be deductible.

Who Can Contribute to a Roth IRA?

If you have MAGI above a certain level, you are not eligible to make a Roth IRA contribution for the year. For example, if you are married and filing a joint tax return for 2023, you may contribute the full amount to a Roth IRA if your MAGI is less than $218,000. If your MAGI is between $218,000 and $228,000, you may make a partial contribution. If your MAGI is $228,000 or higher, you cannot contribute to a Roth IRA for 2023 (but you can still transfer, rollover, or convert retirement savings to a Roth IRA).

SEP, SIMPLE & 401(K)

How Much Can I Save in a SEP IRA Plan?

Only the employer sponsoring the SEP plan may make a SEP plan contribution. The maximum amount an employer may contribute for an employee is the lesser of 25% of an employee’s compensation or the annual dollar limit. Only compensation up to the compensation cap can be considered when calculating a contribution. You may still contribute to the Traditional IRA that receives the SEP contributions (or any other IRA), but your ability to deduct your contribution will be subject to the income limits noted in the Income Limits for Deducting a Traditional IRA Contribution table above.

How Much Can I Save in a SIMPLE IRA PLAN?

Both employees and employers may contribute under an employer’s SIMPLE IRA plan. You may defer compensation up to the annual limit, plus an additional catch-up contribution if you are age 50 or older. Your employer is required to either match your contribution up to 3% or make a 2% contribution regardless of whether you make contributions.