Embracing a Global Stock Market

U.S. stocks have significantly outperformed international stocks in recent years. Does that make international stock diversification unnecessary? Not at all.

U.S. stocks have significantly outperformed international stocks in recent years. And U.S.-based multinationals are major players in the world economy. Does that make international stock diversification unnecessary? Not at all.

International stocks represent 44.9% of the global market—a figure too large to ignore. So by owning international stock investments, you can diversify your portfolio and take advantage of opportunities by leading companies in emerging and other developed stock markets.

Three Reasons to Invest Internationally:

1. Changing market leadership

The rationale for diversification is clear. U.S. and international stocks often swap positions as performance leaders. It wasn’t that long ago that international stocks led the way over domestic stocks, as shown in the figure below. What might the future hold as leaders potentially turn to laggards? Global diversification gives you a chance to participate in whatever region is outperforming at a given time.

2. Positive international outlook

U.S. stocks have had a great run, but will that continue? From a U.S. investor’s perspective, the expected return outlook for non-U.S. stock markets over the next 10 years is 8.4%, higher than that of U.S. stocks (5.1%).

3. Volatility reduction

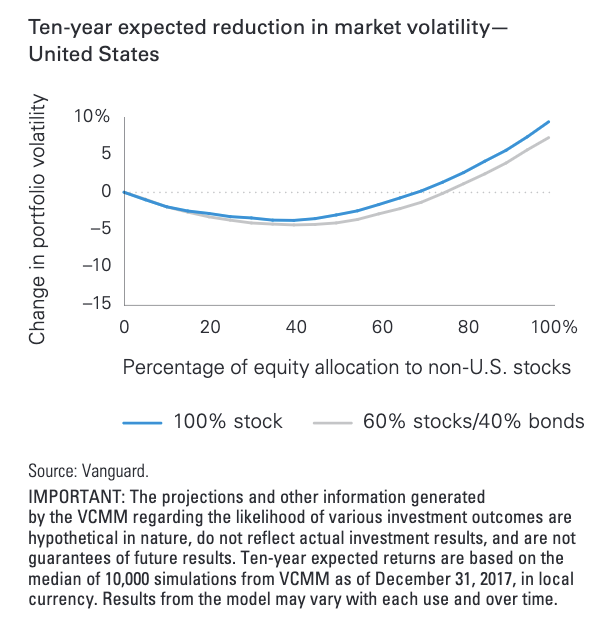

Having a mix of international and U.S. stocks has historically tamped down the volatility in portfolios, as shown in the figure at right. Of course, it’s natural to be concerned about geopolitical risk, but having a mix of U.S. and international can actually reduce portfolio risk. It’s true that correlations have increased between U.S. and international markets as globalization has taken hold, but including international stocks in your portfolio still carries diversification benefits because of less-than-perfect correlations due to differences in economic cycles, fiscal and monetary policies, currencies, and sector weighting.U.S.-headquartered multinational corporations alone don’t provide enough exposure because a big chunk of the world economy is still driven by companies with headquarters outside the United States. You may also lose the potential diversification benefit of foreign exchange. That’s because many U.S. multinational firms seek to smooth their revenues by hedging their foreign-currency exposures.

All investing is subject to risk, including the possible loss of the money you invest.

Diversification does not ensure a profit or protect against a loss.

Investments in stocks issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The VCMM is a proprietary financial simulation tool developed and maintained by Vanguard Investment Strategy Group. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time