4 Reasons to Embrace Global Investing

Recent extreme market volatility can afford you the chance to redeploy your capital in order to help achieve your long-term financial goals. Here are four reasons to embrace global investing.

With rising interest rates and inflation dominating the headlines, you may be considering a shift in your portfolio allocation strategy? You may also be locked into a home bias, not realizing how much this lack of diversification can cost over the long term. Is international investing worth a look? There are some excellent reasons to consider an allocation to investments outside of the U.S.

Financial markets around the world change rapidly in response to news and events, and by avoiding international stocks you are excluding a large portion of the global opportunity set. In fact, international stocks, represent almost 44% of the global market—a figure too large to ignore.1

Recent extreme market volatility can afford you the chance to redeploy your capital in order to help achieve your long-term financial goals. Here are four reasons to embrace global investing.

1. Changing market leadership

The rationale for diversification is clear—U.S. and international stocks often swap positions as performance leaders. What might the future hold as leaders potentially turn to laggards? Global diversification gives you a chance to participate in whatever region is outperforming at a given time.

Here you will see how stock market leadership has alternated in the past between the U.S. and international markets. Rather than choosing one region over another based on past performance, consider focusing on the long-term benefits of a global approach.

Trailing 12-month return differential between U.S. and non-U.S. stocks

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: U.S. equities are represented by MSCI USA Index; international equities are represented by MSCI All Country World Index ex USA. Data as of April 30, 2022.

Sources: Vanguard, Thomson Reuters Datastream, and MSCI.

2. Positive international outlook

U.S stocks have had a great run, but will that continue? While we believe the price/earnings ratios for stocks are some of the best indicators of future returns, we also recognize that you must take into account valuations from a fair-value standpoint, factoring in global economic and market changes.

Based on these valuations, the expected return outlook for non-U.S. stocks over the next 10 years is higher than that for U.S. stocks.

Global non-U.S. equity annualized returns

(in U.S. dollars)

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of March 31, 2022. Results from the model may vary with each use and over time. For more information, please see below.

Source: Vanguard Investment Strategy Group.

3. Volatility reduction

Having a mix of international and U.S. stocks has historically tamped down the volatility in portfolios. Of course it's natural to be concerned about geopolitical risk, but having a mix of U.S. and international equities can actually reduce portfolio risk.

The maximum volatility reduction benefit of adding an allocation to international equities occurs between the 20%–50% range.

Change in portfolio volatility when including non-U.S. stocks in a U.S. portfolio, 1970–2020

Notes: Non-U.S. equities are represented by MSCI World Index ex USA and U.S. stocks are represented by the MSCI USA Index from March 31, 1970, through March 31, 2020. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Sources: Derived from data provided by Vanguard and MSCI as of March 31, 2020.

4. Higher dividend yield

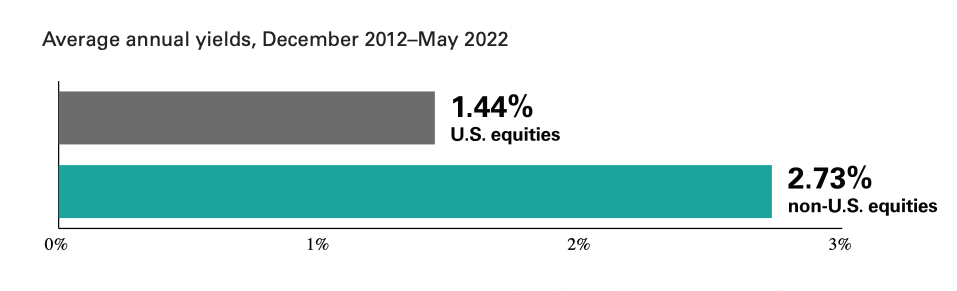

Another reason to look beyond U.S. borders is the higher-yield-generating opportunities available outside the U.S. While domestic dividend-oriented strategies have fared well, international stocks can also offer favorable dividend values.

An international portfolio over the past 10 years experienced a higher dividend yield than that of a U.S.- only portfolio.

Global dividend yields

Sources: Vanguard and FactSet, as of May 31, 2022. U.S. equities are represented by MSCI USA Index and non-U.S. equities are represented by MSCI ACWI Ex-USA Index.