The New Capital JOURNAL

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Fidelity Trusted Contact Persons

Fidelity is now asking that a trusted contact(s) be added to your accounts who they may reach in the event they are unable to get in touch with you, or if they are concerned about your health, well-being, or welfare.

VIDEO: Box leverages RingCentral to enhance communication and collaboration for their workforce

RingCentral empowers today’s mobile and distributed workforces to be connected anywhere and on any device. With an open platform that integrates with today’s leading business apps, RingCentral gives customers the flexibility to customize their own workflows.

Slaying 401(k) Fees at Scale

Announcing two important steps towards our goal of offering the most employee-focused 401(k) platform for small business.

Is Hiring an Advisor "Worth It"?

"Can advisors add enough value to justify their fees?" That was the provocative question posed by a reader recently in an email.

Education Center with Blackrock

The first step towards investing is learning the basics. Explore the different types of investment funds and asset classes and get started with planning for retirement or another life goal.

VIDEO: Getting started with Fidelity BillPay

There’s a better way to pay your bills anytime, anywhere with Fidelity BillPay®. Learn more about how this online service can streamline and take the guesswork out of many of your financial tasks with just a few clicks.

Risk-taking across generations

Millennials who started investing after the global financial crisis are more than twice as likely to hold zero-equity portfolios as those who started investing before.

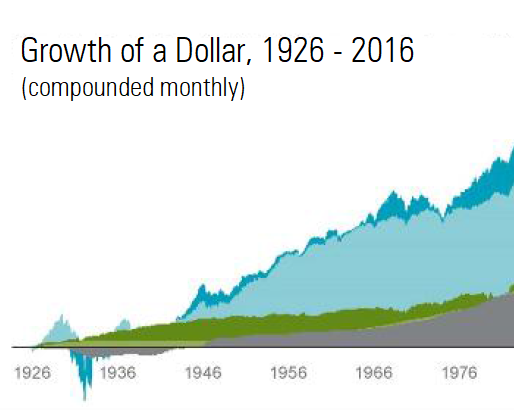

Why Should You Diversify?

With US stocks outperforming non-US stocks in recent years, some investors have again turned their attention towards the role that global diversification plays in their portfolios.

Fidelity 2-Step Authentication with VIP Access

Fidelity offers 2-Step Authentication as a quick and simple way to add an extra layer of security to your Fidelity.com accounts.

CHAIRMAN'S LETTER: To our shareholders

Larry Fink’s Chairman's Letter to Shareholders from BlackRock's 2018 Annual Report

Podcast: A Better Approach to Roth conversions

In this 14-minute podcast, Vanguard Wealth Planning Specialist Boris Wong discusses when Roth conversions make sense from a tax perspective.

Roths beyond retirement: Maximizing wealth transfers

Many investors hold substantial tax-deferred retirement accounts such as traditional IRAs and 401(k)s.

Tackling the tuition bill: Managing higher education expenses

Although many families take advantage of 529 plans and other education-specific savings accounts, most will finance college using a variety of sources and account types.

Pursuing a Better Investment Experience

Review 10 key principles to improve your odds of investments success.

The ABC's of Education Investing

With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses.

Long-term care … what you see ISN’T all there is

Think of long-term care as an incremental expense, not in terms of a lump-sum expense. Do something to prepare, then get out there and enjoy life.

ESG, SRI, and impact investing: A Primer for decision-making

Vanguard’s clear four-step process helps investors establish specific goals, evaluate potential options, and decide on an ESG investing approach based on personalized criteria and trade-off considerations.

Podcast: How To Think About Health Care Costs in Retirement

In this 15-minute podcast, Stephen Weber, an analyst at Vanguard's U.S. Wealth Planning Research Group, takes on this sometimes anxiety-provoking subject and helps advisors and investors find their way around the complex landscape.

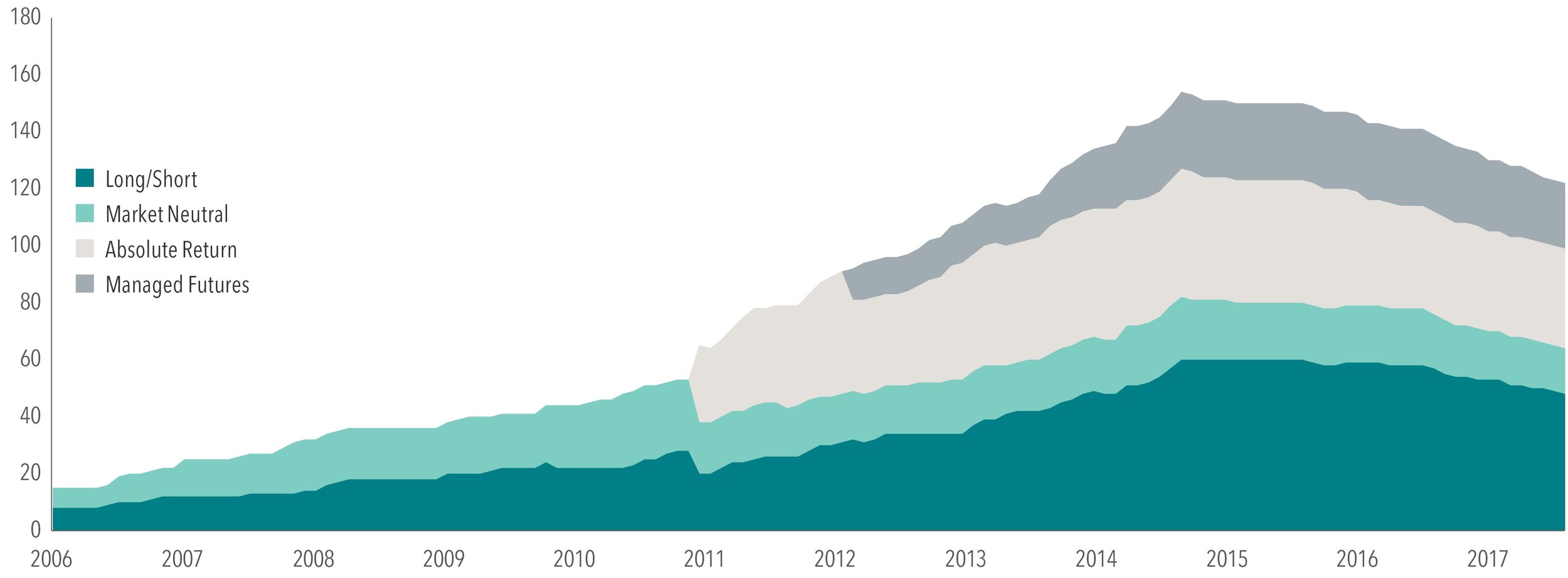

Alternative Reality

Some investors, in search of additional potential volatility reduction or return enhancement opportunities, may even try to extend the opportunity set beyond stocks and bonds to other assets, many of which are commonly referred to as “alternatives.”

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for many investors who adopt this approach to managing their wealth, that can be turned upside down.