The New Capital JOURNAL

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Market Week: September 30, 2019

Investors were hit with potentially worsening trade tensions between the United States and China, along with political uncertainty following the House's impeachment inquiry proceedings against President Trump.

Market Week: September 23, 2019

Following three consecutive weekly gains, stocks closed down last week.

Mid-Year Market Review & Factor Evaluations - Webinar Recording

Watch a recording of our webinar: Mid-Year Market Review & Factor Evaluations

Portfolio & Market Review: Q2 2019

The second quarter was full of ups and downs for stocks as investors had plenty to worry about.

Webinar Invitation: Mid Year Update on Portfolio Performance - July 11th

Stocks have rebounded in the first half of 2019, and bonds have rallied as well. Still, concerns and fears remain prevalent in the market, value and international stocks have under-performed, inflation is quiet, and the yield curve has turned negative. Register now!

Portfolio & Market Review: May 2019

The strong market rally of 2019 came to a screeching halt in May as investors dealt with renewed worries of an escalating trade war between the US and China.

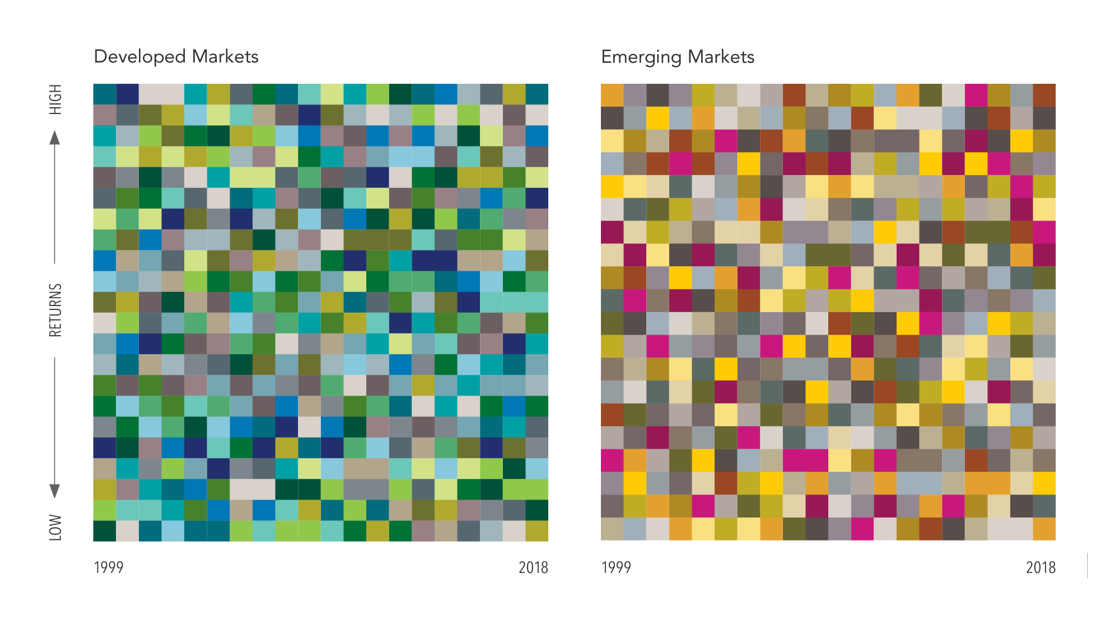

The Randomness of Global Equity Returns

Across more than 40 countries, there are over 15,000 publicly traded companies. If you listen to the news, however, some countries may seem like better places to invest than others based on how their economies and stock markets are doing at the time

Portfolio & Market Review: April 2019

The month of April was a continuation of the strong market momentum we have experienced since the start of the year.

The Uncommon Average

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat.

Introducing Passive Pure Model Portfolios - Webinar Recording

Watch a recording of our webinar: Introducing Passive Pure Model Portfolios

Portfolio & Market Review: Q1 2019

Global markets surged in the first quarter of 2019 as both equity and credit markets rebounded sharply from the lows reached in December of last year.

Guide to Retirement with J.P. Morgan

Retirement is different now than it was in past generations. These days, individuals have varying expectations for how they wish to spend their retirement years. Many planning factors are interconnected, which require careful consideration when developing a retirement strategy.

Q1 Quarterly Market Review

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

New Capital Webinar: New "Passive Pure" Model Portfolios - Thursday, April 25th

Introducing our lowest cost, no transaction fee portfolios designed for the most cost-conscious clients.

Guide To The Markets with J.P. Morgan

The Guide illustrates a comprehensive array of market and economic histories, trends and statistics through clear, compelling charts and graphs you can share with your clients.

Investment Banking with J.P. Morgan

J.P. Morgan counts as its greatest asset the breadth and depth of its client base. Within Investment Banking, the firm works with a broad range of issuer clients, including corporations, institutions and governments, and provides comprehensive strategic advice, capital raising and risk management expertise.

Portfolio & Market Review: February 2019

Global stock markets continued their 2019 rally in February as investor sentiment remained positive given progress in trade talks between the US and China and more clarity regarding the US Federal Reserve’s interest rate policy.

Business Principles with J.P. Morgan

Certain principles are fundamental to our success. They focus on how we strengthen, safeguard and grow our company over time.

Getting to the Point of a Point

What does a point move in the Dow mean and what impact does it have on an investment portfolio.

Portfolio & Market Review: January 2019

In the US, the market shrugged off the longest government shutdown in history as stocks returned 8.0%.