The New Capital Journal

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Map: The World’s Top Countries for Tourism

Where do the world’s international tourist dollars get spent?

Medicare Open Enrollment Begins October 15

The Medicare Open Enrollment Period begins on October 15 and runs through December 7. Any changes made during Open Enrollment are effective as of January 1, 2019.

Roths beyond retirement: Maximizing wealth transfers

Many investors hold substantial tax-deferred retirement accounts such as traditional IRAs and 401(k)s.

Tackling the tuition bill: Managing higher education expenses

Although many families take advantage of 529 plans and other education-specific savings accounts, most will finance college using a variety of sources and account types.

Blockchain Buzz: Emerging Tech Offers Potential, Not Promises

Here's an introduction to blockchain and a glimpse into how this emerging technology might impact the future of businesses around the world.

Final Chance to Undo a 2017 Roth IRA Conversion

If you converted a traditional IRA to a Roth IRA in 2017 and your Roth IRA has sustained losses, you may want to consider whether it makes sense to undo your conversion.

IRS Shuts Down State Tax Workaround

The IRS has released proposed regulations that would shut down some suggested workarounds for the new $10,000 limit on the deductibility of state and local taxes (SALT).

Natural Capital

Sound economic policies, in any economic system, must support both the preservation and growth of all forms of capital, not just money capital. On earth, the most important and abundant form of capital is natural capital - the earth’s land, water, and air – without which no other capital formation is possible.

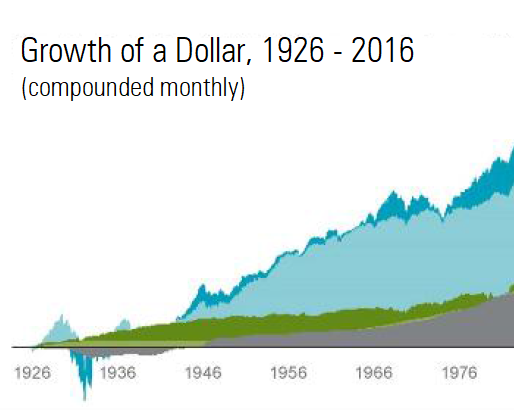

Pursuing a Better Investment Experience

Review 10 key principles to improve your odds of investments success.

The ABC's of Education Investing

With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses.

Long-term care … what you see ISN’T all there is

Think of long-term care as an incremental expense, not in terms of a lump-sum expense. Do something to prepare, then get out there and enjoy life.

ESG, SRI, and impact investing: A Primer for decision-making

Vanguard’s clear four-step process helps investors establish specific goals, evaluate potential options, and decide on an ESG investing approach based on personalized criteria and trade-off considerations.

Viva Mexico

While Cortes came to Mexico to conquer, our family is currently spending our annual summer travel by enjoying the many facets of this extraordinary country: its lovely climate, incredible cuisine, historic sites, great architecture, stunningly cheap prices, and especially its kind and industrious people.

U.S. Fiscal Issues: Larger Deficits Are Driving Up Debt

Here's a closer look at the nation's current fiscal situation and what it could mean for future economic growth.

Podcast: How To Think About Health Care Costs in Retirement

In this 15-minute podcast, Stephen Weber, an analyst at Vanguard's U.S. Wealth Planning Research Group, takes on this sometimes anxiety-provoking subject and helps advisors and investors find their way around the complex landscape.

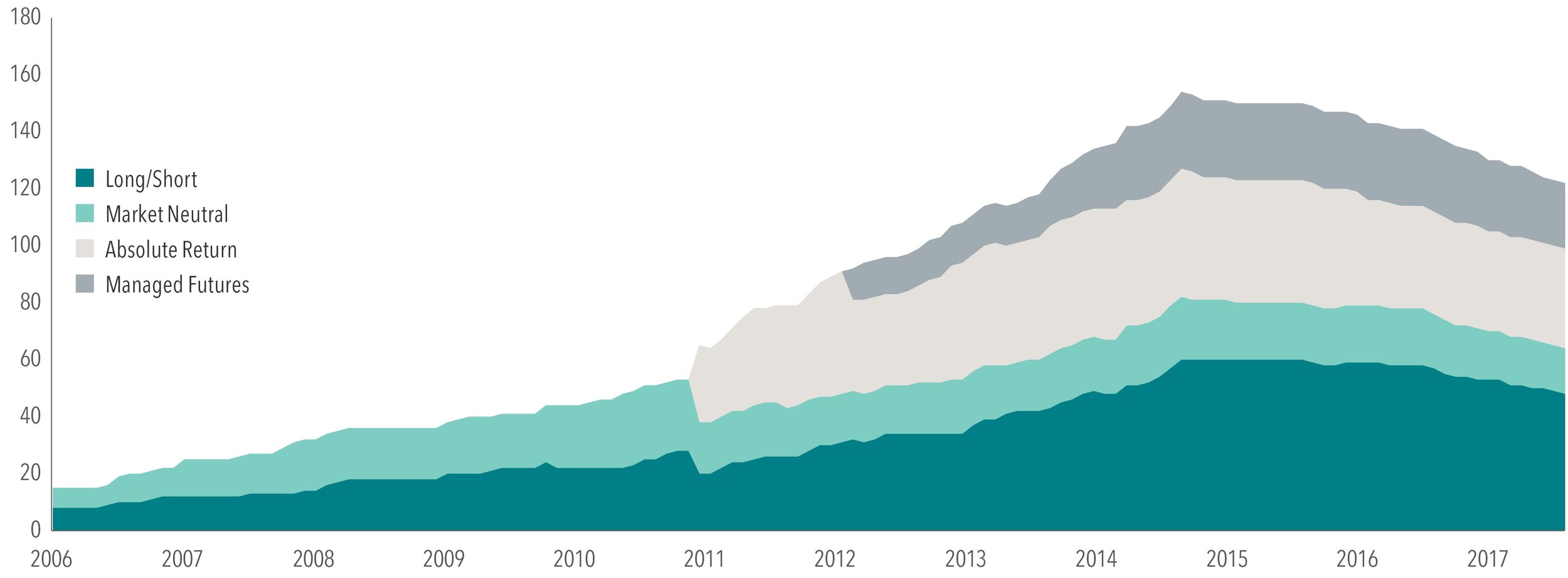

Alternative Reality

Some investors, in search of additional potential volatility reduction or return enhancement opportunities, may even try to extend the opportunity set beyond stocks and bonds to other assets, many of which are commonly referred to as “alternatives.”

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for many investors who adopt this approach to managing their wealth, that can be turned upside down.

Declarations

Many in our nation report being conflicted about their feelings during this holiday given the deep level of civil and political strife now present in daily life.

Pain at the Pump: Why Does It Cost More to Fill Your Tank?

If you're like most consumers, you may feel that you're playing gas-price roulette every time you fill the tank.

Where's the Value?

From 1928–2017 the value premium in the US had a positive annualized return of approximately 3.5%. In seven of the last 10 calendar years, however, the value premium in the US has been negative.