The New Capital Journal

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Federal Income Tax Returns Due for Most Individuals

The federal income tax filing deadline for most individuals is Tuesday, April 17, 2018.

There's Still Time to Contribute to an IRA for 2017

There's still time to make a regular IRA contribution for 2017! For most taxpayers, the contribution deadline for 2017 is April 17, 2018.

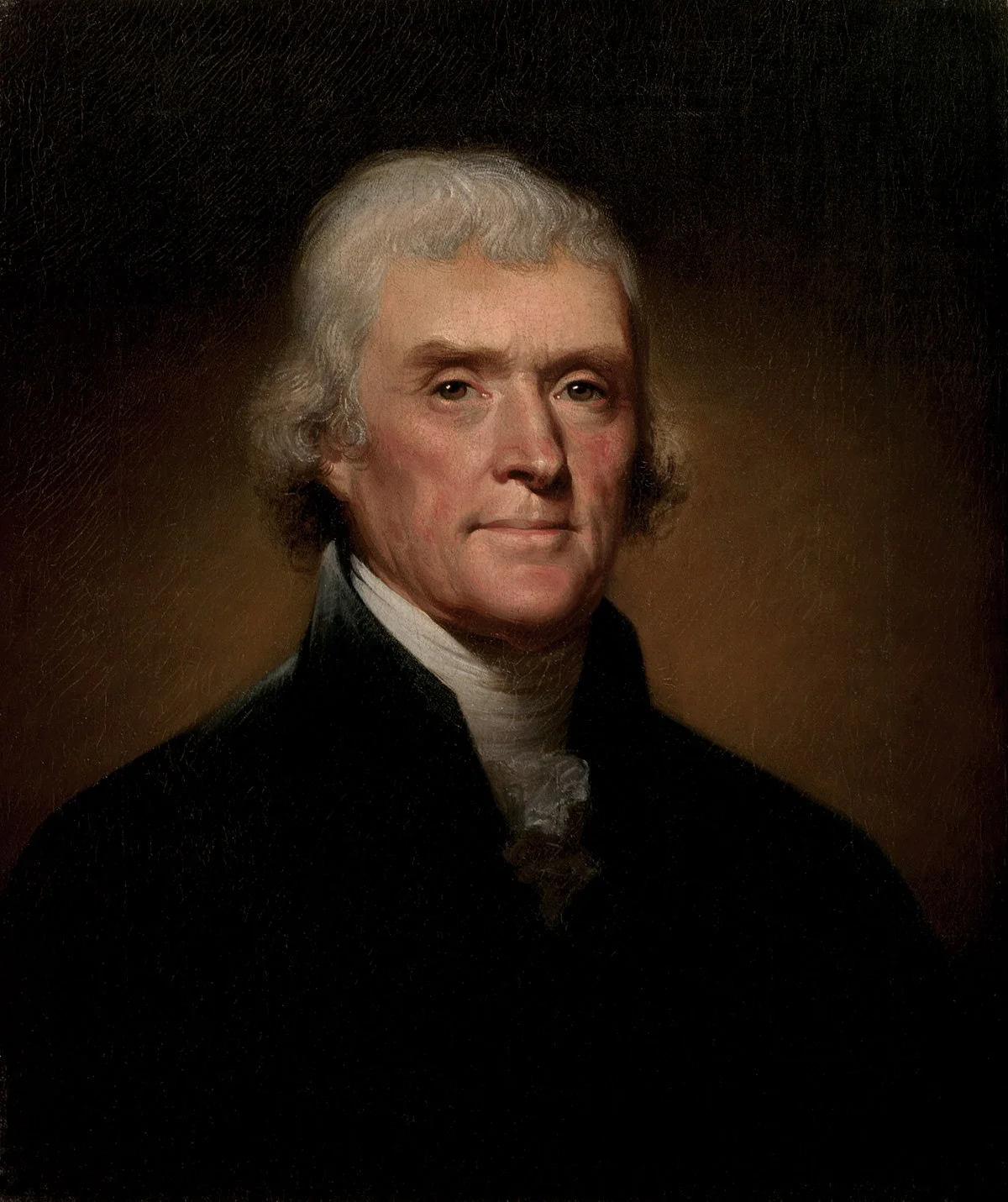

Evils That Never Happen

“How much pain have cost us the evils which have never happened.” In a time of greater market volatility, national political and geopolitical concerns, and technological change, it is natural to worry, and worry is often painful.

Correction Time: The Market Takes a Hit

After reaching all-time highs on January 26, 2018, the Dow Jones Industrial Average and the S&P 500 went into a two-week slide.

Fiduciary Obligations and Down Markets

It cannot be emphasized enough: there is a world of difference between a broker and an advisor, even though much of the American investing public is aware of neither the distinction nor the difference.

Markets Turn Down

Markets have hit a rough patch to start February after a very strong recent period of performance. We are very lucky to have a wonderful client base that has been through many market downturns.

Tax Cuts and Jobs Act: 529 Plans Expanded

College students and their parents dodged a major bullet with the legislation, as initial drafts of the bill included the elimination of Coverdell Education Savings Accounts, the Lifetime Learning Credit, and the student loan interest deduction.

Storms and Boats

2017 was tumultuous not just in Houston but in the entire United States of America, building on the very dramatic and nation altering election-related events of 2016. Much of the tumult, of course, continues to be related to American politics generally and specifically the highly volatile Trump presidency.

Tax Cuts and Jobs Act: Impact on Business

The Tax Cuts and Jobs Act, a $1.5 trillion tax cut package, was signed into law on December 22, 2017. The centerpiece of the legislation is a permanent reduction of the corporate income tax rate.

2018 Insurance Planning Key Numbers

Eligible long-term care premium deduction limits

Per diem limit

Archer Medical Savings Accounts

Flexible spending account (FSA) for health care

Health Savings Accounts (HSAs)

2018 Estate Planning Key Numbers

Key Estate Figures

2017 and 2018 gift and estate tax rate schedule

2018 Investment Planning Key Numbers

Maximum tax on long-term capital gains and qualified dividends

Unearned income Medicare contribution tax ("net investment income tax")

2018 Business Planning Key Numbers

Adoption Assistance Program, Earnings subject to FICA taxes (taxable wage base), Health insurance deduction for self-employed, Qualified transportation fringe benefits, Section 179 expensing, Small business tax credit for providing health-care coverage, Special additional first-year depreciation allowance, Standard mileage rate (per mile), Tax on accumulated earnings and personal holding company income

2018 Education Planning Key Numbers

Coverdell education savings accounts

Deduction for qualified higher education expenses

Education loans--interest deduction

Gift tax exclusion

Kiddie tax

American Opportunity and Lifetime Learning Credits

U.S. savings bonds--interest exclusion for higher education expenses

2018 Retirement Planning Key Numbers

Employee/individual contribution limits

Employer contribution/benefit limits

Compensation limits/thresholds

Tax Cuts and Jobs Act: Impact on Individuals

On December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act, a sweeping $1.5 trillion tax-cut package that fundamentally changes the individual and business tax landscape.

Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act legislation was signed into law on December 22, 2017. The Act makes extensive changes that affect both individuals and businesses.

Year-End Charitable Giving

The tax benefits associated with charitable giving could potentially enhance your ability to give and should be considered as part of your year-end tax planning.

Junk Jitters: What's Behind the Exodus from High-Yield Bonds?

For the one-week period ending on November 15, 2017, investors withdrew a net $4.43 billion from U.S. funds holding high-yield bonds (often called junk bonds) — the third largest exodus from such funds on record.

What Will You Pay for Medicare in 2018?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium in 2018 will remain $134 (or higher, depending on your income).