Why Roth IRAs Rock

Investors have more ways than ever to fund Roth accounts under the Secure Act.

Thanks to Secure Act 2.0, investors now have more options for funding Roth accounts on their own and with their employer’s assistance. But before we get excited about these provisions, consider two critical questions: Does the investor have access to a particular Roth option? And is a Roth more suitable for them than a traditional account?

Roth IRAs Get Better

Generally, any amount investors add to their Roth will be from amounts already taxed the year for which the contribution is added to their account. And, for the right person, Roth accounts provide opportunities to pay taxes at rates projected to be lower than tax rates.

Distributions of Roth contributions would be tax-free. So would the earnings if the distribution is made at least five years after they fund their Roth account, if they are at least 59½ or disabled when the distribution is made.

Additionally, there are no required minimum distributions for Roth IRA owners. For designated Roth accounts, RMDs are repealed for participants effective 2024.

For beneficiaries, Roth accounts mean tax-free inheritance.

Like any tax strategy, Roth accounts are not for everyone, but they provide an avenue to reduce taxes for the right taxpayer. The right taxpayer can afford to pay the income tax due at the time any conversion and contributions are made and will pay less income tax as a result of choosing Roth instead of traditional accounts.

Funding a Roth IRA

Investors can make contributions to their Roth IRA if they meet any applicable eligibility requirements.

Regular Roth IRA Contributions

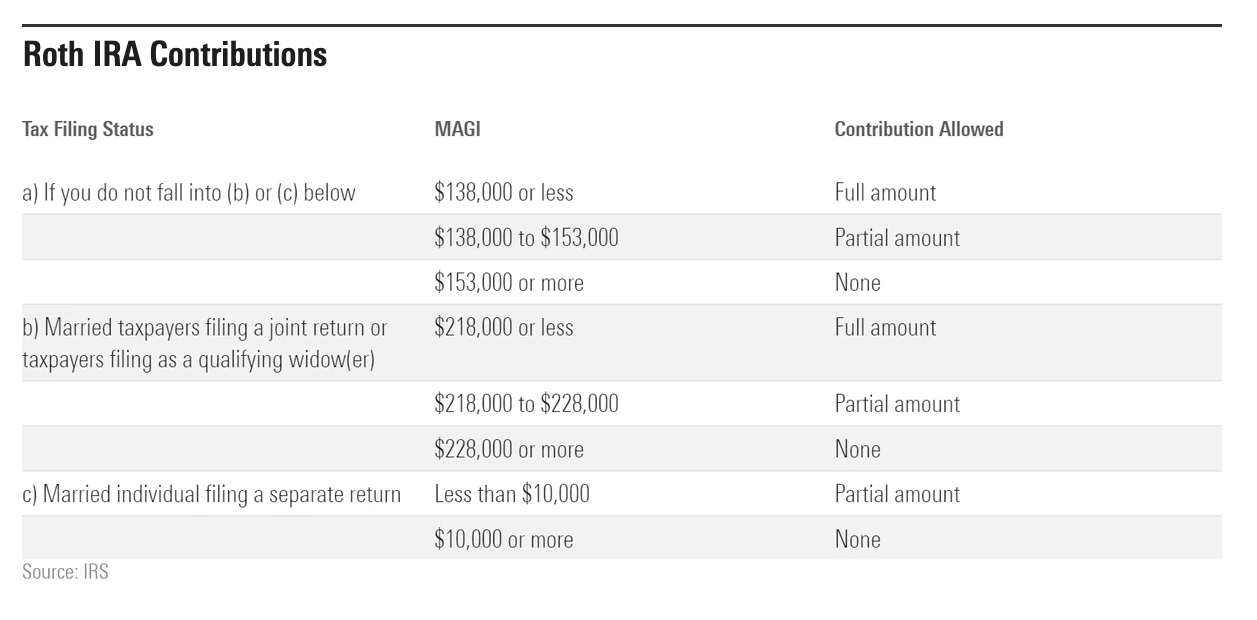

If taxpayers’ modified adjusted gross income, or MAGI, is below the higher amounts in the ranges in the following table—for example, $153,000 for someone whose tax-filing status is single—they can make a regular contribution to their Roth IRA.

Source: IRS

The “full” amount for 2023 is the lesser of 100% of taxpayers’ eligible compensation or $6,500. If they are at least age 50 by the end of the year, they may contribute an additional $1,000 as catch-up contributions.

If they fall into the “partial” range, their tax preparer can determine how much they may contribute.

If their MAGI is too high, they can use the backdoor Roth IRA contribution strategy to get their contribution into their Roth IRA.

Roth Conversions and Rollovers

Taxpayers may also convert eligible amounts from their traditional IRAs, SEP IRAs, SIMPLE IRAs, and employer plans to their Roth IRA. Any pretax amount included in the conversion would be taxable income.

529 Conversion to a Roth IRA

Effective for distributions from 529 plans after Dec. 31, 2023. As with Roth accounts, 529 plans are funded with already-taxed amounts. But earnings in a 529 plan are taxable and subject to the 10% additional tax on early distributions unless the distribution is used to cover qualified education expenses.

Secure Act 2.0 allows 529 plan beneficiaries to protect unused amounts from income tax, including the 10% additional tax (early distribution penalty), by converting up to $35,000 to a Roth IRA. A 529 plan to Roth conversion is permitted if the 529 plan has been maintained for at least 15 years. But amounts contributed to the plan during the five years before the conversion cannot be converted to a Roth IRA.

Finally, the maximum amount that can be converted for a year—when added to any other regular traditional and Roth contributions made for the year—cannot exceed the regular IRA contribution limit in effect. Individuals who want to use this provision must make sure that the conversion is done as a direct conversion, where the amount is paid directly to the receiving custodian for the benefit of the Roth IRA.

Once the amount is credited to the Roth IRA, it becomes subject to the Roth IRA distribution rules.

Funding a Roth With the Help of Employer

If an investor’s employer offers a retirement plan with a Roth feature, they may make Roth contributions to those accounts. Contributions to Roth IRAs do not affect Roth contributions to employer plans.

The Roth options for employer plans are as follows:

Salary Deferral to 401(k), 403(b), or Governmental (457(b)) Plans

An employer may add designated Roth accounts as a feature under their 401(k), 403(b), or governmental (457(b)) plan. In such cases, an employee may make salary deferral contributions to their designated Roth accounts or traditional accounts. Alternatively, they may split their salary deferral contributions between their traditional account and designated Roth account.

Higher catch-up limits: The salary deferral contribution may not exceed the employee’s compensation and is capped at $22,500 for 2023. If the employee is at least age 50 by the end of the year, they may make an additional catch-up contribution of $7,500.

Effective 2025, the catch-up contribution limit will be higher for those aged 60 to 63 as of the end of the year. For 2025, the limit is: the greater of $10,000 (indexed for inflation) or 150% of the regular catch-up limit for 2024.

Note that employers can limit contributions to lower amounts than the salary deferral limits in effect for the year.

Designated Roth account only catch-up rule: While employees can choose to make their salary deferral contribution to their traditional account or designated Roth account, or split it between the two, an exception applies if the compensation the employee receives from their employer during the preceding year is more than $145,000 (indexed for inflation). Under that exception, the catch-up contribution must be made to a designated Roth account. This provision is effective in 2024.

Employer Matching and Nonelective Contribution

Before the enactment of Secure Act 2.0, all employer contributions to 401(k), 403(b), and governmental 457(b) plans could be made only to pretax accounts under these plans. Effective the date of enactment of Secure Act 2.0, employers may allow participants to elect to have employer matching and nonelective contributions deposited to their designated Roth accounts.

Salary Deferral for SEP IRAs and Roth IRAs

Effective 2023, Secure Act 2.0 allows employers to give participants the option of having their SEP-IRA and SIMPLE IRA contributions made to Roth IRAs.

The salary deferral limit for a salary deferral SEP (SAR-SEP) is the same as the limits for a designated Roth account (above). SAR-SEPs were repealed in 1997, but those established in 1996 and earlier are grandfathered, allowing them to continue.

The salary deferral limit for a SIMPLE IRA is $15,500 for 2023. If an employee is at least 50 years old by the end of the year, they may make catch-up contributions of up to $3,500.

Higher catch-up limits: Effective 2025, the catch-up contribution limit will be higher for employees aged 60 to 63 as of the end of the year. For 2025, the limit is the greater of $5,000 (indexed for inflation) or 150% of the regular catch-up limit for 2025.

Employer SEP and SIMPLE Contributions

Like salary deferral contributions, employers may allow employees to elect to have their SEP and SIMPLE employer contributions made to Roth IRAs, effective 2023.

Bonus: No RMDs for Owners and Participants

Effective for taxable years beginning after Dec. 31, 2023, individuals must take annual RMDs from their IRAs and employer plan accounts beginning when they reach their applicable RMD age.

One of the reasons for RMDs is for the IRS to get its deferred revenue from tax-deferred amounts. For that reason, it made sense that Roth IRA owners were not subject to RMDs. Yet, despite Roth 401(k) sharing the same tax feature as Roth IRAs wherein they are funded with already taxed amounts, Roth 401(k) owners were subject to RMDs.

The Secure Act changes that as of 2024, where any RMDs that would have been due for 2024 and after no longer apply to designated Roth accounts.

Caution: This does not apply to any RMDs due for 2023 and earlier, including for someone who reaches their applicable RMD age in 2023 and who can, therefore, take that 2023 RMD in 2024 by April 1.

The RMD rules continue to apply to inherited Roth IRAs and designated Roth accounts, where the RMD requirements depend on whether the owner died before 2020, whether the owner died before the starting date for their RMDs, and whether the beneficiary is a designated beneficiary, eligible designated beneficiary, or nondesignated beneficiary.

Are You Roth-Suitable?

An important point of consideration for choosing a Roth over a traditional account is that Roth contributions are not tax-deferred. Generally, this means the amount would be included in the investor’s taxable income for the year the contribution applies. For this reason, consideration must be given to affordability. Can the investor afford to give up the tax deferral or tax deduction for their contributions?

A Roth suitability assessment—based on factors that include the investor’s current tax rate and the projected future tax rate of them and their beneficiaries—could be helpful. Sometimes, the solution might be to split the amounts between traditional and Roth accounts.