What to Know About Inherited IRAs

A beneficiary’s options depend on the IRA owner’s age at death and the beneficiary’s category.

IRAs are an important estate planning tool for passing wealth directly to loved ones outside of probate – and even tax-free with a Roth IRA. But it’s important to understand that the rules have changed for how quickly IRA beneficiaries must withdraw inherited assets from IRAs. Beneficiaries need to understand these rules because if a required payment isn’t taken, the IRS can assess a 50% excise tax on the amount that should have been withdrawn.

Beneficiaries have always been required to deplete an inherited IRA within a certain number of years, but the SECURE Act of 2019 changed the rules, effective for beneficiaries who inherit IRA assets on or after January 1, 2020. The IRS proposed regulations to provide the details needed to implement these new rules, but that proposal included some unexpected interpretations, which have caused questions for the industry. The IRS will clarify these outstanding “gray areas” when it publishes final regulations, which is expected to happen in 2023. In the meantime, beneficiaries may want to seek tax, legal, or financial advice for assistance with mitigating the tax liability of their payments or designing a distribution or investment strategy that aligns with their payment options.

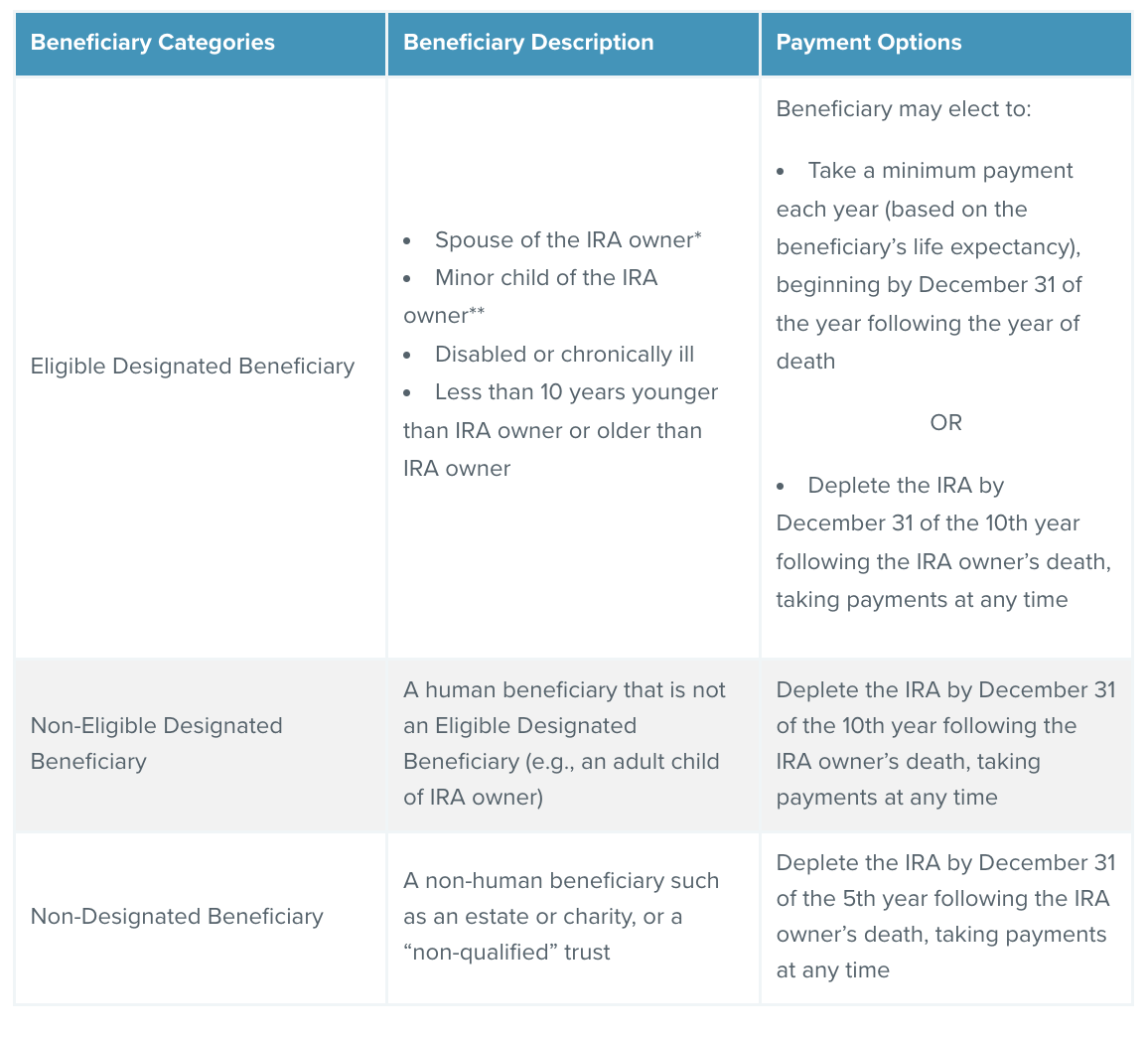

The following chart summarizes the payment options available under the proposed regulations. A beneficiary’s options depend on the IRA owner’s age at death and the beneficiary’s category. Of course, beneficiaries can always withdraw inherited assets more quickly than required.

IF IRA OWNER DIES BEFORE THE REQUIRED BEGINNING DATE

Traditional IRA owners must start taking annual required minimum distributions (RMDs) by April 1 of the year following the year they reach age 72. This is called the required beginning date (RBD). If a Traditional IRA owner dies prior to their RBD, the beneficiary is subject to the following rules. Roth IRA beneficiaries are always subject to these rules.

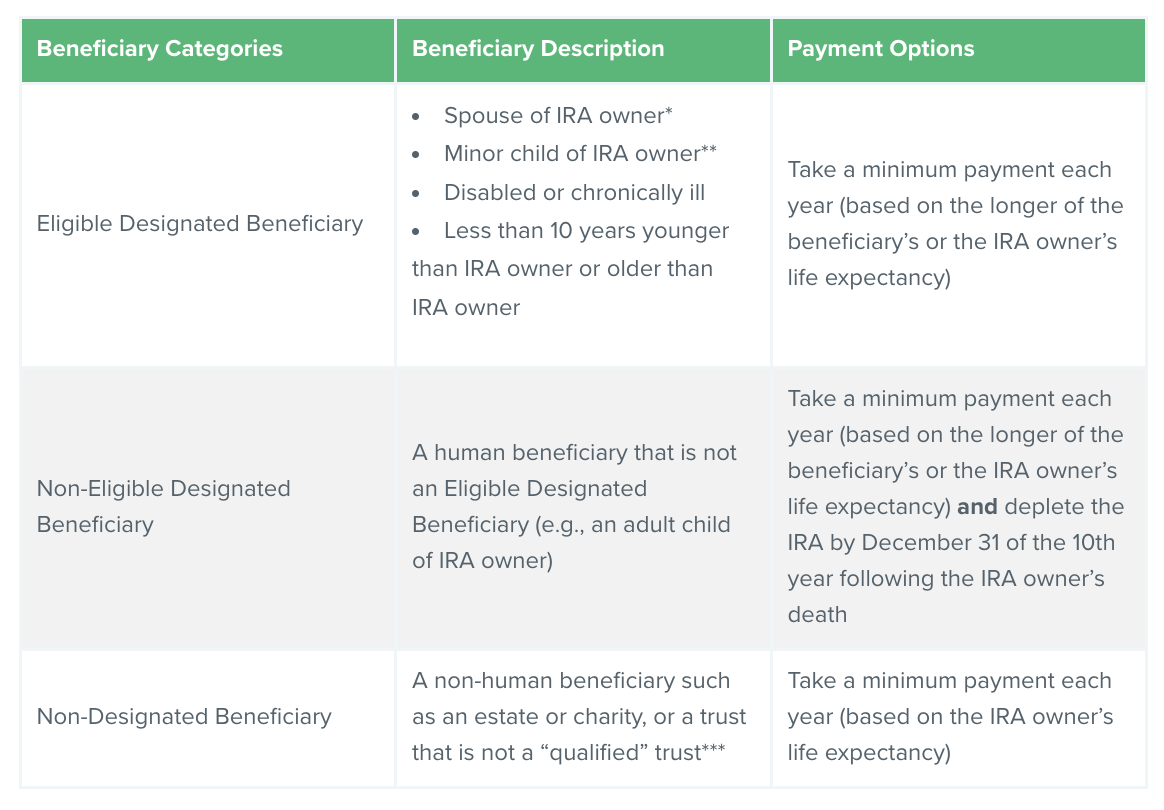

IF IRA OWNER DIES AFTER THE REQUIRED BEGINNING DATE

If a Traditional IRA owner dies after April 1 of the year following the year they reached age 72, their beneficiaries must take any of the IRA owner’s remaining RMD in the year of death and begin taking annual life expectancy payments by the end of the following year.

A spouse beneficiary may wait until the deceased spouse would have reached their RBD to begin taking distributions. A spouse beneficiary may also choose to treat the inherited IRA as their own IRA or transfer or roll over the inherited assets to their own IRA, but should do so by the latter of:

December 31 of the year following the year of the IRA owner’s death, or

December 31 of the year in which the spouse beneficiary attains age 72.

**Minor children may take annual payments until they reach the age of majority (age 21 according to IRS proposed regulations). Then, they must deplete the IRA within 10 years (i.e., by age 31).

***If a trust qualifies as a “look through” trust, it may be treated as an Eligible Designated Beneficiary or a Designated Beneficiary for determining inherited IRA distribution options.

RELIEF FOR NON-ELIGIBLE DESIGNATED BENEFICIARIES SUBJECT TO 10-YEAR RULE

One of the outstanding issues from the IRS’s proposed regulations is the requirement for Non-Eligible Designated Beneficiaries to take annual payments in addition to depleting the IRA within 10 years. The reason behind this requirement is that the IRA owner had reached an age at which the tax laws require annual distributions from the Traditional IRA to make sure the assets don’t remain sheltered from tax beyond the IRA owner’s life expectancy. Thus, the beneficiary inheriting the IRA assets must continue the annual payment structure. This interpretation, while part of the existing statute, was not expected to be applied to the new 10-year rule.

Because of the confusion this interpretation caused in the industry, the IRS issued Notice 2022-53 to provide relief from the 50% excise tax for beneficiaries who were required to take payment in 2021 or 2022 under the proposed regulations. This relief applies to a beneficiary who:

1) inherited an IRA in 2020 or 2021 from an IRA owner in RMD status, AND

2) is subject to the hybrid annual payment/10-year rule, AND

3) missed a payment in 2021 or 2022.

This relief also applies to a successor beneficiary who missed a payment in 2021 or 2022 if they inherited an IRA from an Eligible Designated Beneficiary (including beneficiaries who inherited prior to 2020) who was taking annual life expectancy payments.