Mapped: The Salary Needed to Buy a Home in 50 U.S. Metro Areas

The Salary Needed to Buy a Home in 50 U.S. Metro Areas

Over the last year, home prices have risen in 49 of the biggest 50 metro areas in the United States.

At the same time, mortgage rates have hit seven-year highs, making things more expensive for any prospective home buyer.

With this context in mind, today’s map comes from HowMuch.net, and it shows the salary needed to buy a home in the 50 largest U.S. metro areas.

The Least and Most Expensive Metro Areas

As a reference point, the median home in the United States costs about $257,600, according to the National Association of Realtors.

With a 20% down payment and a 4.90% mortgage rate, and taking into account what’s needed to pay principal, interest, taxes, and insurance (PITI) on the home, it would mean a prospective buyer would need to have $61,453.51 in salary to afford such a purchase.

However, based on your frame of reference, this national estimate may seem extremely low or quite high. That’s because the salary required to buy in different major cities in the U.S. can fall anywhere between $37,659 to $254,835.

The 10 Cheapest Metro Areas

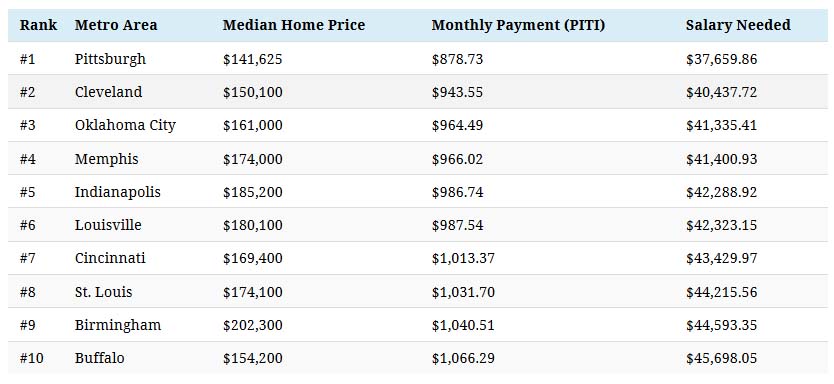

Here are the cheapest metro areas in the U.S., based on data and calculations from HSH.com:

After the dust settles, Pittsburgh ranks as the cheapest metro area in the U.S. to buy a home. According to these calculations, buying a median home in Pittsburgh – which includes the surrounding metro area – requires an annual income of less than $40,000 to buy.

Just missing the list was Detroit, where a salary of $48,002.89 is needed.

The 10 Most Expensive Metro Areas

Now, here are the priciest markets in the country, also based on data from HSH.com: