NCM Cash Management Options

New Capital has assembled a comprehensive lineup of both cash and cash equivalents.

In the wake of:

The steep rise in interest rates, especially short-term interest rates.

The Silicon Valley Bank failure and associated US banking stress

…many investors are turning to investment advisors rather than to traditional banks for cash management services, as advisors often have access to a greater number of options, often with higher yields. We have received many inquiries from clients in this regard. Cash refers to U.S. dollar currency, and cash equivalents refers to securities that are not cash but are widely traded, highly liquid (i.e., can be easily converted to cash), and whose values and volatilities closely behave like those of cash. Over the past year, as rates have re-inflated, New Capital has assembled a comprehensive lineup of both cash and cash equivalents as follows:

Bank Sweep Program. Through Fidelity, New Capital is able to provide a bank sweep facility of $2.5 million per individual household, or $5 million per joint household. With a bank sweep, Fidelity places client cash across various member banks with up to $250,000 each, the amount of Federal Deposit Insurance Corporation (FDIC) insurance. This facility eliminates the need for clients to open many separate accounts at various banks themselves, as the facility is managed by New Capital and Fidelity. This option is recommended for clients who want to hold “traditional bank cash” in their New Capital account.

Bank Certificates of Deposit. CD’s are time deposits with banks, which have a fixed rate of return and date of maturity (much like a bond). CD’s are insured by the FDIC. Because CD’s have longer duration/maturities than demand deposits, they most often have higher interest rates (although that is not always the case if yield curves are inverted). Fidelity offers a large warehouse of CD’s that trade on the secondary market (rather than directly issued by a bank); this results in a very large selection of CD’s and the ability to re-sell CD’s without penalties. This option is recommended for clients who want to hold “traditional bank cash” at higher yields in their New Capital account.

Money Market Funds. Money market funds are essentially extremely short term bond funds, with overall durations ranging from one to two weeks. They therefore “behave” like cash as their underlying holdings are close to maturity. Often, they offer higher yields than bank interest. Money market funds are not generally insured from losses, however losses are extremely rare and funds are designed to maintain their $1.00 net asset value per share. Money market funds are often backed by repurchase agreement type debt, wherein a borrower agrees to repurchase a debt from a lender at a specific close-in date and set price so that maturity and price uncertainties are eliminated. Often these debts are issued by the Federal Reserve, government affiliated institutions like the Federal Home Loan Bank, and creditworthy corporations. This option is recommended for clients who wish to hold extremely low duration cash equivalents with higher yields and whose value mirrors that of cash (i.e., is notionally completely stable, though not guaranteed, at $1.00 per share net asset value).

U.S. Treasury Bonds. Treasury bonds, given the extremely strong credit of their issuer (the U.S. government) can act as a cash equivalent especially when their duration is shorter. New Capital has access to the purchase of individual secondary market Treasuries through Fidelity, as well as Treasury-only bond funds through Vanguard and BlackRock iShares. This option is recommended for clients who wish to hold a cash equivalent in the form of Treasuries.

Enhanced Cash Model (ECM). New Capital offers a portfolio model that is composed of ultra short term and short term bond exchange traded funds (ETF’s). This portfolio offers relatively high interest rates, as it includes holdings in both ultra short term Treasuries and corporate debts. This option is recommended for clients who wish to hold a high yielding diversified portfolio of cash equivalents.

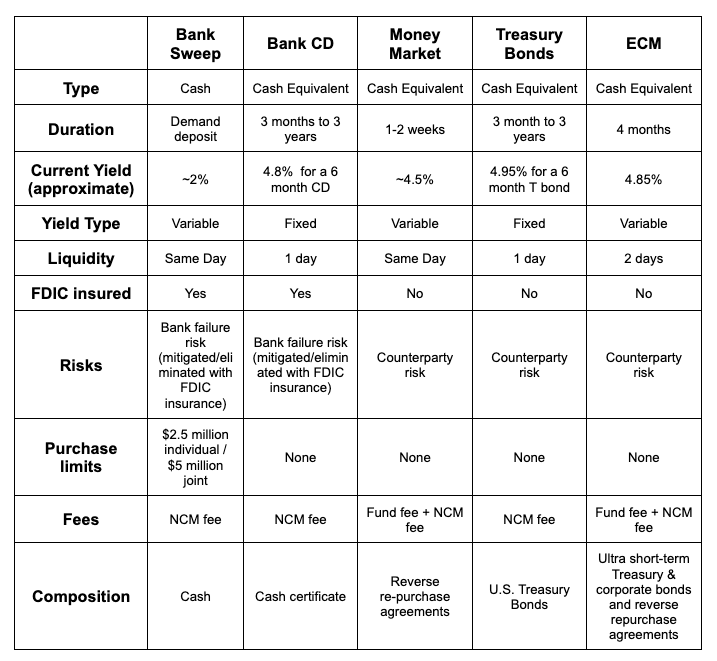

The following table summarizes key characteristics of these options:

Please note that our model portfolios already contain significant allocations to cash equivalents. However, if you believe that you have significant material needs for additional cash management services, please let us know and we will be happy to assist you.