More Perfect

Part I. Politics

We the people of the United States, in order to form a more perfect Union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity, do ordain and establish this Constitution for the United States of America. - Preamble, U.S. Constitution

We are not enemies, but friends. We must not be enemies. Though passion may have strained it must not break our bonds of affection. The mystic chords of memory, stretching from every battlefield and patriot grave to every living heart and hearthstone all over this broad land, will yet swell the chorus of the Union, when again touched, as surely they will be, by the better angels of our nature. - Abraham Lincoln, First Inaugural Address, March 4, 1861

Happy New Year.

As a financial advisor, my primary goal is to help you get, be, and/or stay financially healthy - and also indirectly support your physical, mental, emotional, and other forms of health as well, since finances are very often involved with these other things. And if there are areas where I feel another professional can be of assistance in helping you achieve some form of health (i.e., estate health, tax accounting health), we facilitate that as well.

I am not only a helper - I am also helped by many helpers. I am the product of a fine home and my parents, and a great education and its teachers. In my current life, I receive the help of physicians and trainers to keep my body healthy; of therapists and mentors to keep my mind healthy; of spiritual advisors to keep my heart healthy. My family and friends are a constant background of positive reinforcement and help. And my colleagues at New Capital, and you, our clients, give me daily purpose to work hard and fulfill my personal meaning. More than anything, I am lucky, and my gratitude for this fortuitous state of being is boundless.

It didn’t have to be this way for me. If I was to take part in a violent riot in the U.S. Capitol, especially as the entire Congress and the Vice-President performed their solemn Constitutional duty of certifying state Electoral votes, I would utterly risk my relationships with my life’s helpers (including you). I would have made a choice to essentially waste all of the vast investment made to date to help me.

It conversely makes sense that anyone who would participate in such an appalling event may well be unhealthy in critical ways, including an inability to discern unhealthiness in their own leader. How so many in the United States in 2021 came to be so unhealthy - in body, mind, spirit, finances, and other ways as well - is something that should be studied, understood, and remediated.

It is already generally understood that much more help is needed for many in the United States. Our health insurance system, due largely to the historical artifact of the tax deductibility of employer paid healthcare premiums, is a mess, with some Americans covered by gold-plated plans and Medicare, while others pay exorbitant deductibles with no co-payment benefits, and still others lack any coverage at all. Many plans, moreover, exclude mental health services, the very thing that would help many Americans overcome inevitable life crises whether in relationships, career, personal development, child rearing, or political obsessions - it is no wonder that many Americans turn to charlatans, whether in political office or online, when they cannot afford credible professional help. Many Americans lack sufficient income to save for retirement, education, or even household basics, and many children live in poverty. Education in our country is highly unequal, as is access to the Internet, green space, clean air, clean water, equal justice, and equal opportunity. The list, of course, could go on.

To fix problems, one must first see problems. With the turbulent Election of 2020 now complete, the United States is about to embark on a period of legislative reform not seen since the 1930’s and 1960’s. Federal legislation, much of it already passed by the House of Representatives but currently blocked by the outgoing Senate Majority Leader, is now ready to emerge into the light of day in many different areas of American life including education, healthcare, energy, environment, infrastructure, immigration, law enforcement, and government ethics. Many of these changes will have the goal of enhancing the overall health of America and Americans. My view is that these efforts may well also have salubrious effects on businesses too, and therefore potentially on some of your investments.

As each of us regards these changes, we should refrain from pre-judging them based solely upon our predisposed political biases and instead ask the question: will this, on balance, truly help others who clearly need help? If the answer is “yes”, then we may also conclude that such changes may well have benefits for ourselves as well, in the form of a more perfect union. After all, the word “economy” is derived from the Greek roots meaning “household management”, and as in any household, when some suffer, all suffer, and when some heal, all heal. The past week makes that clear, when sadly deluded people, many of them lied to repeatedly by the highest office holder in the land, expressed their personal suffering not by working with a therapist, developing a meditation practice, visiting with a trusted clergyman, or taking other steps to address their anger and circumstances, but instead by ransacking our nation’s Capitol, resulting in the deaths of several, including a policeman.

Nevertheless, as 2021 begins, I am optimistic about the year ahead despite the evident challenges in front of all of us. A pandemic will begin to end, and our normal lives will start to return. The more perfect Union sought within the Constitution, the better angels that Abraham Lincoln was sure existed, will soon hopefully emerge to assure that the health needs - financial, physical, mental, spiritual - of both our community and our individuals and families are met.

Regardless, we at New Capital stand ready to assist you in achieving whatever good health is attainable by you, and to continue to help protect your wealth from dangerous charlatans, wherever they may be found.

Part 2: Investments

Be fearful when others are greedy, and greedy when others are fearful. - Warren Buffett

In the short term, the market is a voting machine. In the long term, it is a weighing machine. - Ben Graham

Toward the end of 2020, certain areas of the investment landscape became euphoric. And while I am not fearful about this, investment euphoria is always cause for concern for a professional investor, as we never want to get caught on the wrong side of such an environment.

Here’s the problem, illustrated by Goldman Sachs and our friend Bret Stanley, former manager of the AIM/Invesco Value Equity group and founder of Stanley Capital Management:

The chart shows that the U.S. stock market stands, largely (but not only) as a result of the 2020 pandemic, with the largest performance spread in history between growth stocks and value stocks, in favor of growth stocks. However, if you look closely at the data to the right of the vertical blue double arrow (the most recent observations) you will see that this trend began to reverse at the end of the year, as value stocks took over market leadership.

You can see this situation also reflected in valuations, as the following chart shows an approximately 25 point spread - a record, although the tech bubble of 2000 was close - in price/earnings valuations between the most expensive and least expensive stocks:

As a result of this gaping disparity, many investment professionals predict (Jaycee and I listened to such views from Fidelity’s research group last week) that as coronavirus vaccines are administered this year, we may well continue to see a rotation out of those companies that benefited from the virus (think Zoom, Amazon, et. al.) into those that suffered from the virus (think Southwest Airlines, Exxon, et. al.).

I am never in the prediction business, but unless the laws of investment have been revoked, and I don’t think they have or ever will be, I support this view. If it comes to pass, your portfolio with New Capital is poised to benefit.

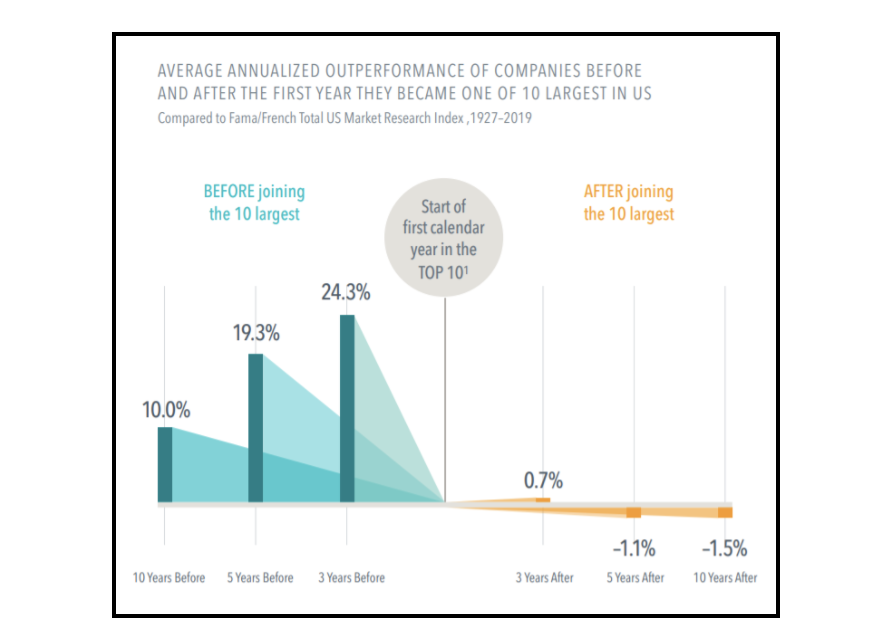

I want to caution all clients to understand that when markets drive up the prices of assets beyond reasonable, future returns are compromised. Here is a fascinating graphic that shows the historical aggregate performance of the various top ten most valuable companies dating back to 1927:

The lesson is clear: on average, on the way up (the blue bars), a Top 10 company has spectacular returns, especially in the 3-5 years before breaking into the Top 10. But as soon as it breaks into the Top 10, their returns have turned down - way down. In fact, during the ten years after breaking into the Top 10, the average annual return for a Top 10 company (the yellow bars) fell to negative 1.5% a year.

While startling, this makes sense: the more successful, fast growing, and profitable a company is, the more it attracts investors jumping onto its stock bandwagon, driving its stock price higher and higher. But the higher the stock price goes, the more it reduces the potential for future returns.

While U.S. growth stocks, especially large ones, are trading at the very expensive levels noted above, there remain significant parts of the stock market trading at much more reasonable valuations, including value stocks and international stocks. I remain committed to ensuring that your portfolio has a prudent allocation to these less expensive areas of the market as well.

In fixed income (bonds), we saw interest rates reach rock bottom levels in 2020. As a result, I reduced bond “duration” in most portfolios, selling longer term bonds and acquiring shorter term bonds. While this reduced the yield on bond portfolios, it also reduced the risk from a rebound in interest rates - which actually occurred in the second half of the year, when shorter term bonds outperformed longer term bonds.

Finally, inflation, which has been low or virtually absent for a long time may be poised for a comeback. In 2020, the Federal Reserve loosened its commitment to restraining inflation, and 2021 promises to be a year of very rapid growth as the world returns from lockdowns. Approximately 33% of New Capital’s bond portfolios are now invested in Treasury inflation protected bonds to guard against inflation risk.

I will look forward to bringing you updates throughout 2021, and I wish you the best for this year. Please note that 2020 Year End Reports will be released in the next few days, and you may expect 1099 tax forms from Fidelity and our other custodians toward the end of January and into February.

In the meantime, if there is anything that any of us at New Capital can do for you, please do not hesitate to let us know. We are here, of course, to help.

Leonard Golub, CFA

Fiduciary Financial Advisor

We’d Love To Hear From You