Markets Brief: Value Stocks Have Suffered In 2023 but Are Showing Signs of Recovery

These stocks have led the latest gains for the value side of the market.

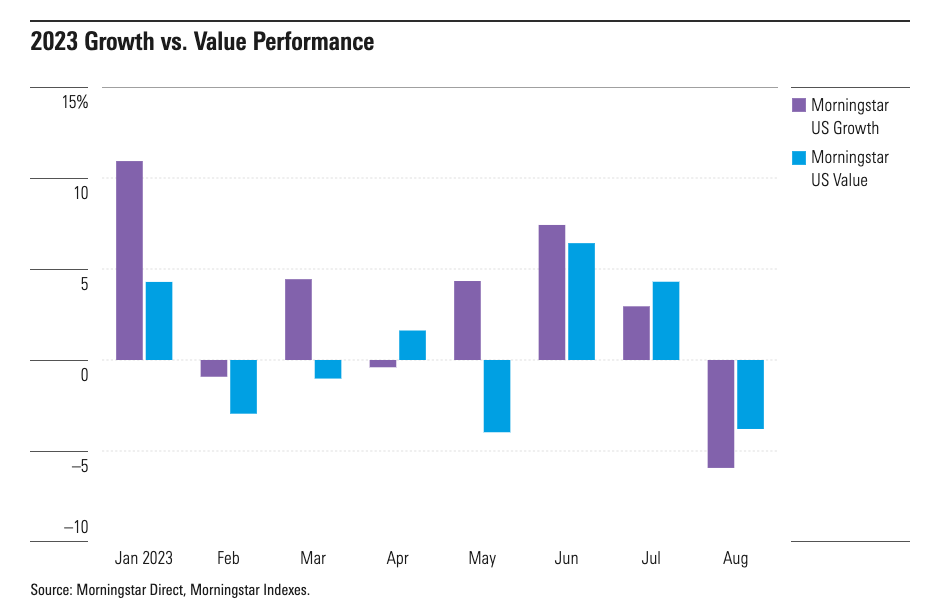

After lagging far behind the growth stock rally through the first half of the year, value stocks have recovered some ground in recent months. However, they broadly remain left in the dust by growth stocks after the so-called “Magnificent Seven” rally.

But since June, growth stocks have lost ground, while value stocks have overall been flat. The Morningstar US Value Index is down just 0.3% for the second half of the year through Aug. 22, and the Morningstar US Growth Index is down 3.1%. That’s a shift from the first half of the year when growth stocks gained roughly 28% and the value index rose just 4%. Leaders of this recent recovery include Amgen AMGN and Berkshire Hathaway BRK.B.

The largest value stocks have led the style box for the year’s second half. The Morningstar Large Value Index gained 0.3% while every other corner of the style box fell into negative territory except for large blend stocks, up 0.1% as a group.

After gaining over 30% in the first half of the year, the US Large Growth Index has lost traction. The group lost 2.2% for the second half through Aug. 22, dragged down by heavyweight Apple AAPL (down 8.5% for July and August) and Fortinet FTNT (which lost 22.8%).

Which Value Stocks Have Led Since June?

Among value stocks, names from the financial services, healthcare, energy, and technology sectors have led gains for the second half of the year so far. At the industry level, general drug manufacturers and diversified insurance companies have been the leading contributors. Oil and gas exploration and production companies such as EOG Resources EOG positively impacted the index’s overall gains.

Pharmaceutical giant AbbVie ABBV has been the number-one contributor to the Morningstar Value Index since June, up 11.2% for the period. Morningstar analysts now see the narrow-moat stock as overvalued.

Multinational biopharmaceutical company Amgen has made the second-largest contribution (up 17% for the period and now in fairly valued territory), followed by heavyweight financial services conglomerate Berkshire Hathaway (which rose 2.8% since June).

Growth Stock vs. Value Stock Performance History

Looking back over the past 12 months, value and growth stocks have ended up in roughly the same spot. The US Growth Index rose 5.3% for the period, while the US Value Index gained 5.2%. That’s largely because during the 2022 bear market, growth stocks had their worst calendar year in decades while value stocks stayed flat.

In the longer term, growth stocks have mostly dominated. Over the three-year trailing period, value stocks have also seen a 14% average annual return, far ahead of the 3.3% average annual return for growth-oriented names. During this period, small-value stocks led the Morningstar Style Box with an average annual return of 18.1%. Small growth fared the worst, with an average annual loss of 1.2%.

But for the five- and 10-year periods, growth stocks have held onto the performance advantage that dominated the market prior to 2022. The US Growth Index rose 10.5% over the last five years through Aug. 22, 2023, while the value index is up 7.1% per year. Over the last 10 years, the growth index is up 13.4% while the value index is up just 9.2% through Aug. 22, 2023.

For the Trading Week Ended Aug. 25

The Morningstar US Market Index rose 0.77%.

The best-performing sectors were technology, up 2.5%, and real estate, up 0.8%.

The worst-performing sectors were energy, down 1.4%, and consumer defensive, down 0.7%.

Yields on 10-year U.S. Treasuries decreased to 4.23% from 4.25%.

West Texas Intermediate crude prices fell 1.75% to $79.83 per barrel.

Of the 862 U.S.-listed companies covered by Morningstar, 457, or 53%, were up, and 405, or 47%, were down.

What Stocks Are Up?

Shares for Splunk SPLK and Palo Alto Networks PANW rose after both software companies posted stronger-than-expected quarterly results against a backdrop of macroeconomic uncertainty.

Splunk generated $911 million in sales during the second quarter, up 14% from the same period during the previous year. Additionally, the firm gained $445 million in cloud revenue, up 29% from the same timeframe). While product demand and sales growth weakened due to macro headwinds, “the long-term demand outlook for Splunk remains robust,” Morningstar analyst Malik Ahmed Khan writes.

Investors were pleasantly surprised by Palo Alto’s results for its fiscal fourth quarter. The company generated close to $2 billion in sales and about $3 billion in annual recurring revenue, which increased 56% year over year. Khan attributes the results to the firm’s investment in diversifying its range of products. “Forward-looking indicators such as billings and remaining performance obligations also showed strength, growing 18% and 30%, respectively,” he adds.

For its fiscal second quarter, Nvidia NVDA posted another round of strong results and increased its outlook, sending its stock up. The semiconductor manufacturer generated $13.5 billion in revenue, which is up 88% sequentially and up 101% year over year.

The company continues to benefit from the hype for artificial intelligence since programs using such software are trained using its chips. Morningstar technology sector director Brian Colello expects the firm to generate a revenue of $41 billion when it completes its January-ended fiscal year from its data center business, which includes AI graphic processors. The projection is well ahead of the $15 billion generated the previous year and $3 billion from four years ago.

What Stocks Are Down?

Hawaiian Electric Industries HE stock continues to plunge after Maui County filed a lawsuit against the company on Aug. 24. The utility is one of four firms that the county alleges “acted negligently by failing to power down their electrical equipment despite a National Weather Service Red Flag Warning” ahead of heavy winds on Aug. 7. The lawsuit claims the company’s power lines ignited dry vegetation, causing massive wildfires on the island.

Shares for retailers of discretionary goods such as Dick’s Sporting Goods DKS, Macy’s M and Dollar Tree DLTR plummeted amid concerns of weakened consumer spending, as shown in their quarterly reports.

For its second quarter, Dick’s reported a weakened gross margin of 34.5%, which the retailer attributes to higher levels of thefts and the discounting of excess products such as outdoor merchandise. Additionally, Morningstar senior equity analyst David Swartz notes the firm’s operating expenses were 24.1% of sales, 150 basis points above his forecast. “Investors and analysts had overestimated Dick’s competitive position of three years of strong results,” he writes.

While its second-quarter sales and earnings were above expectations, Macy’s reduced its full-year guidance for credit card revenue by about 10%. The department store chain attributed the move to rising expenses from bad debt, which Swartz sees as “a sign that its largely middle-income customer base is feeling the effects of inflation.”

Dollar Tree beat expectations for earnings and revenue for its fiscal second quarter and raised its outlook for sales. However, the discount retail chain cut its annual profit forecast, saying consumers are passing over discretionary goods in favor of spending on essential items such as groceries. “Cautious consumer spending and heightened sensitivity to price increases drove another quarter of tight margins, with no near-term turnaround catalyst apparent,” Morningstar equity analyst Sean Dunlop writes.