Building the Retirement Income Pyramid

Retirement planning isn’t easy. As more and more people approach retirement age, they’re turning to their financial advisors to help them tackle the difficult task of turning their savings into an income stream that will help fund their retirement goals for the rest of their lives.

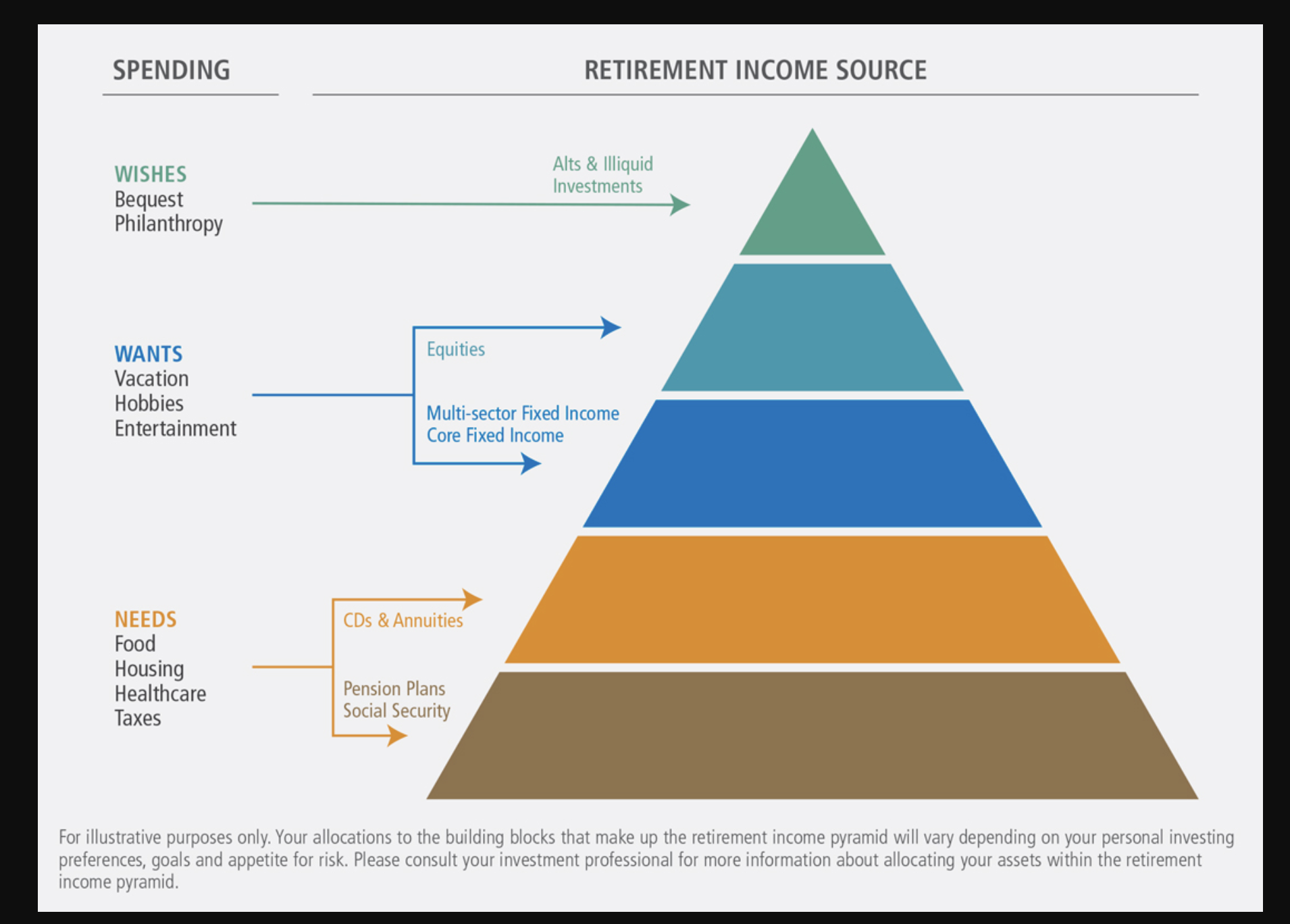

What this chart shows

In retirement portfolios, different types of investments address different objectives. Some aim to provide stable income to fulfill life’s needs, while others aim to generate attractive levels of growth and income to support and maintain a lifestyle.

What it means for investors

In retirement, preserving capital and receiving a dependable stream of income are your most critical concerns. The retirement income pyramid can help address these goals – while guarding against volatility, market shocks, interest rate risk and other threats to your long-term financial security.