Charted: Unemployment and Recessions Over 70 Years

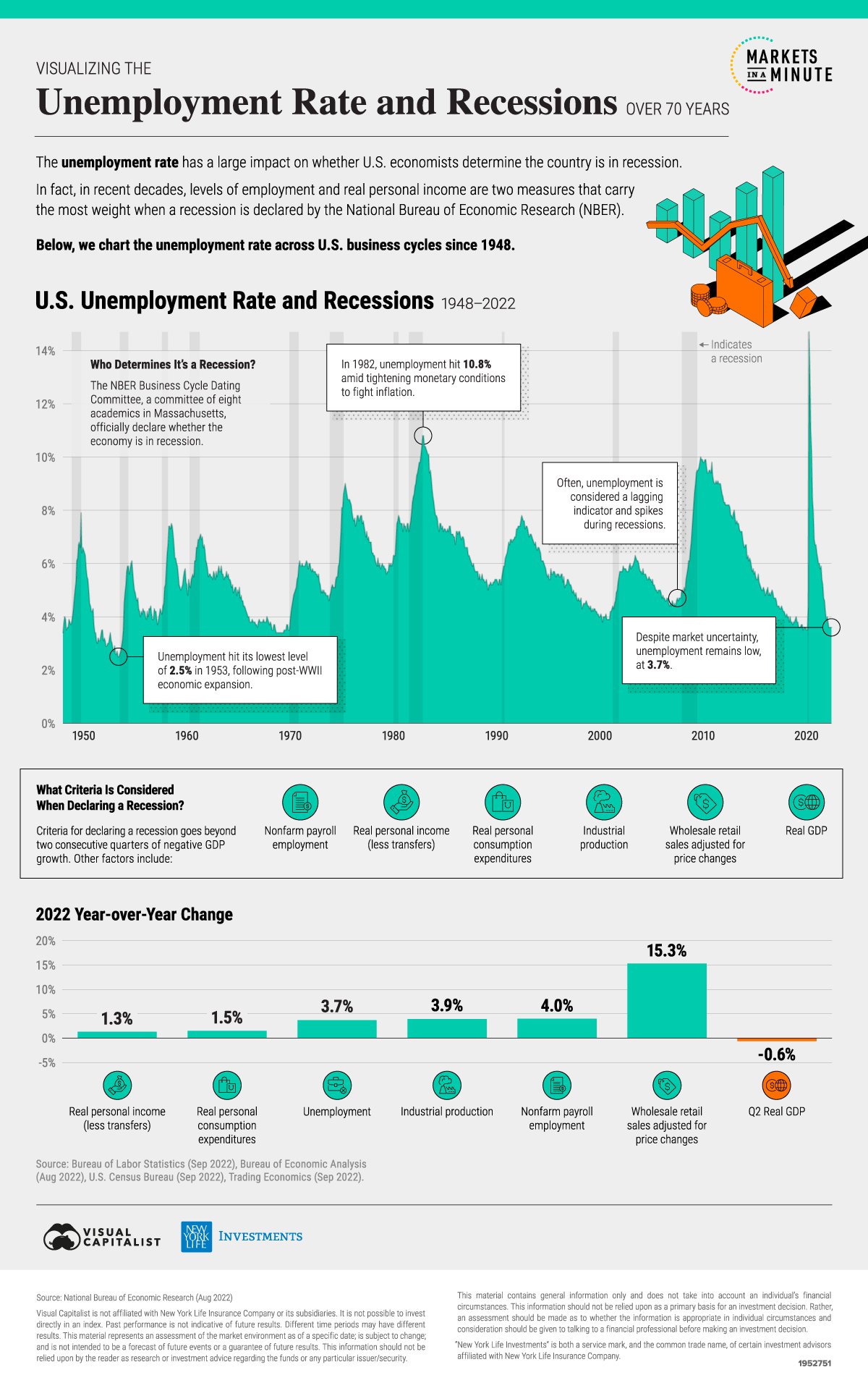

Levels of employment and real personal income are two measures that carry the most weight when a recession is declared.

Charting Unemployment and Recessions Over 70 Years

As of August 2022, the U.S. unemployment rate sits at 3.7%, below its 74-year average of 5.5%.

Why does this matter today? Employment factors heavily into whether economists determine the country is in a recession. In fact, in the last several decades, employment-related factors have some of the heaviest weightings when a recession determination is made.

In this Markets in a Minute from New York Life Investments, we look at unemployment and recessions since 1948.

Why Is the Unemployment Rate Important?

To start, let’s look at how unemployment affects the economy.

During low unemployment and a strong labor market, wages often increase. This is a central concern to the Federal Reserve as higher wages could spur more spending and notch up inflation.

To curb inflation, the central bank may increase interest rates. As the economy begins to feel the effects of rising interest rates, it may fall into a recession as the cost of capital increases and consumer spending slows.

Who Determines It’s a Recession?

A committee of eight economists at the National Bureau of Economic Research (NBER) in Massachusetts make the call, although often several months after a recession has happened. As a result, employment data often acts as a lagging indicator.

This committee of academics looks at a number of variables beyond two consecutive quarters of negative GDP growth. Other factors include:

Nonfarm payroll employment

Real personal income less transfers

Real personal consumption expenditures

Industrial production

Wholesale retail sales adjusted for price changes

Real GDP

A widespread decline in economic activity across the economy, as opposed to just one sector, is also considered.

Unemployment and Recessions Over History

Over the last 12 business cycles, the unemployment rate averaged 4.7% at the peak and 8.1% during the trough. The below table shows how the unemployment rate changed over various U.S. business cycles, with data from NBER:

In 1953, following post-WWII expansion, the unemployment rate fell to 2.6%, near record lows.

During this time, the economy faced strong consumer demand and high inflation after a period of prolonged low interest rates. To combat price pressures, the Federal Reserve increased interest rates in 1954, and the economy fell into recession. By May 1954, the unemployment rate more than doubled.

In 1981, the unemployment rate was high during both the peak of the cycle (7.2%) and the trough (10.8%) by late 1982. This marked the end of the 1970s stagflationary era, characterized by slow growth and high unemployment.

More recently, at the peak of the business cycle in 2020 the unemployment rate stood at 3.5%, closer to levels seen today.

Unemployment Today: A Double-Edged Sword

As of July 2022, the number of job vacancies is at 11.2 million, near record highs.

To reign in the inflationary pressures of the current job market—which saw year-over-year wage increases of 5.2% in both July and August—the Federal Reserve may take a more aggressive stance on interest rate hikes.

The good news is that labor force participation is increasing. As of August, labor force participation was within 1% of pre-pandemic levels, offering relief to the labor market supply. Higher labor force participation could lessen wage growth without unemployment levels having to rise. Since more people are competing for jobs, there is less leverage for salary negotiation.

Going further, one study shows that since the Great Financial Crisis, labor market participation has had a greater influence on wage growth than unemployment levels or job openings.

Against these opposing forces of higher job vacancies and higher labor market participation, the outlook for unemployment, along with its wider effects on the economy, remain unclear.